North Tyneside Council Tax

(In association with the Local Public Message Board)

Last year's page (2014/15) is still available here.

2015/16 Update

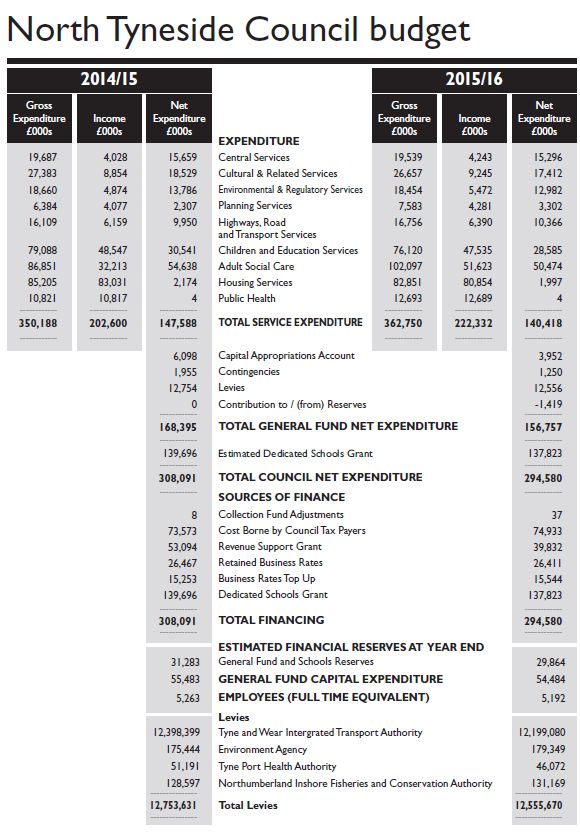

As usual, the graph plots below have been drawn up from the council tax booklets supplied by NTMBC over the last 19 years. Again, for the third year no council tax booklet has been posted to council tax payers but a version was available on the council's website in PDF - Council Tax Booklet 2015/16. A single page budget summary can be found at the bottom of this page.

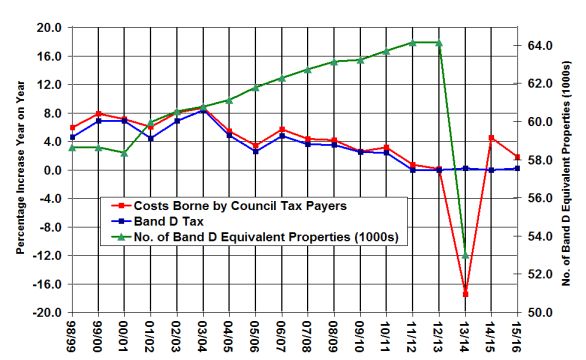

The graph above shows the % rise from one year to the next for the total council tax (Costs Borne by Council Tax Payers) and the Band D council tax, for the tax years 98/99 to 15/16. The difference is linked to the increase in the number of properties subject to council tax, but not wholly explained by this. Two years ago there was a dramatic change in both the Costs Borne by Council Tax Payers and the No. of Band D Equivalent Properties. The latter quantity, more formally referred to as the Council Tax Base, was reduced from 64,219 to 53,006. I have not sought out the revised Council Tax Base for this year and will no longer update a figure for this in future graphs. (The account for the change as given to me by North Tyneside Council can be found in the Council Tax notes for the tax year13/14.)

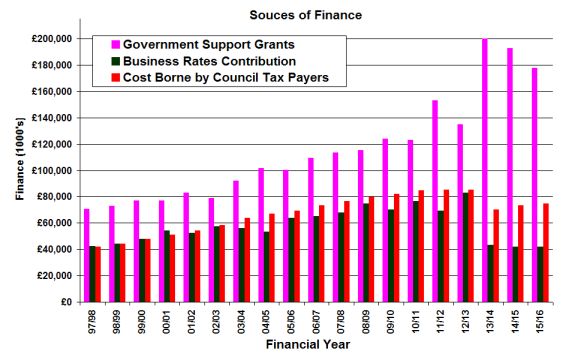

In the graph above the Revenue Support Grant and the Dedicated Schools Grant have been added together, as in earlier years, and I continue to call it, "Government Support Grants". This year there has been a further slight drop in the Dedicated Schools Grant (from £139.7 m to £137.8 m) and a big drop in the Revenue Support Grant (from £53.1 m to £39.8 m).

There has been a small increase in the Business Rate Contribution from £41.7 m to £42.0 m. There are two components of this - as introduced last year - one is Retained Business Rates (£26.41m) and the other is called Business Rates Top Up (£15.54m)

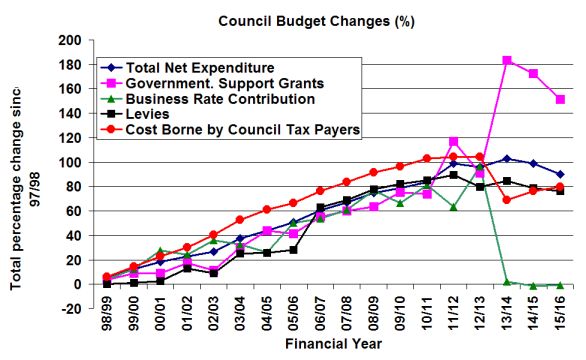

The "Total Net Expenditure" in the graph below includes the Dedicated Schools Grant. (It is the Total General Fund Net Expenditure + the Dedicated Schools Grant!)

The graph above shows the total % rise for a variety of components of the council's total (revenue account) expenditure since 1997/8. The total % rise in Band D council tax (not shown) since 1997/8 is 84.3 percent. (A rise from £809 to £1490.99).

A more detailed explanation of the introduction of the Localised Council Tax Support Scheme and Council Tax Base can be found in the report to the cabinet on 31 January 2013 referred to on this page of the NTC Website.

R Smith 2 September 2015

If you wish to comment on this webpage please contact Robin Smith by email.