North Tyneside Council Tax

(In association with the Local Public Message Board)

The earlier page last updated on 31 March 2010 is still available here.

20011/12 Update

As usual, the graph plots below have been drawn up from the Council Tax booklets supplied by NTMBC over the last 15 years.

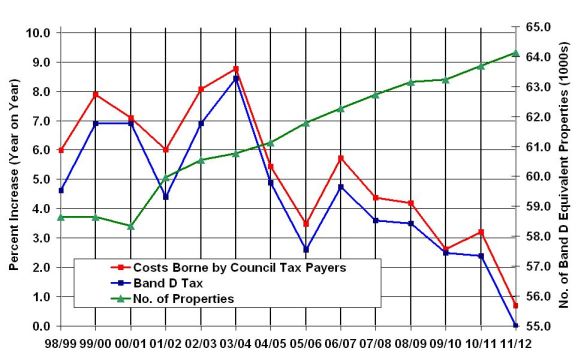

The graph above shows the % rise from one year to the next for the total council tax (Costs Borne by Council Tax Payers) and the Band D council tax, for the tax years 98/99 to 11/12. The difference is linked to the increase in the number of properties subject to council tax, but not wholly explained by this.

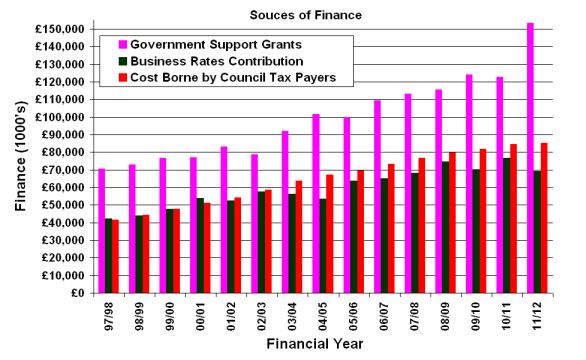

This year the Revenue Support Grant and the Dedicated Schools Grant have been added together, as in earlier years, but I have renamed it "Government Support Grants". There has been a large increase in the Dedicated Schools Grant (£20 million) and in the Revenue Support Grant (£10 million). Last year use was made of an Area Based Grant (£18 million) and reserves (£4 million) to reduce the Total General Fund Net Expenditure where as this year there is no Area Based Grant and only £2.9 million has been taken from reserves.

The Total Expenditure in the graph below includes the Dedicated Schools Grant. (It is the Total General Fund Net Expenditure + the Dedicated Schools Grant!)

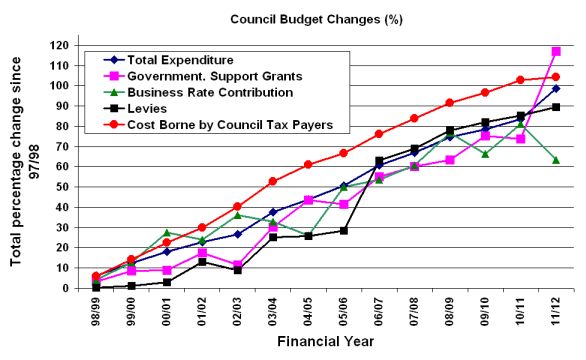

The graph above shows the total % rise for a variety of components of the council's total (revenue account) expenditure since 1997/8. The total % rise in Band D council tax (not shown) since 1997/8 is 83.5 percent. (This can be compared to the RPI increase since 1997 of some 49 %.)

R Smith 2 May 2011

If you wish to comment on this webpage please contact Robin Smith by email.